This article tries to compare the pros and cons of renting a property short term vs. long term.

Short term means, the property can be rented day by day, typically to tourists, for an average duration of 1 to 3 weeks. Maximum in the context of this article is 3 months.

Long term means, the property is rented for 1 year or longer, typically to residents. Minimum in the context of this article is 6 months.

The grey zone of 3 to 6 months is rare and not considered in this article.

Example: 1-bedroom apartment in Port de La Mer. Assumed purchase price: AED 1,800,000. All following figures are in AED.

| Long term (1 year) | Short term (AirBnB) | |

|---|---|---|

| Gross rent | 120,000 | 180,000 |

| -Cleaning/DTCM (Tourism tax) | -600 | -10,000 |

| -Management/Consumables | -6000 | -45,000 |

| -Electricity/Water/TV/Internet/HT | -800 | -9,000 |

| -Service Charges | -14,000 | -14,000 |

| -Vacancy/Grace period | -15,000 | 0 |

| Net rent | 83,600 | 102,000 |

| ROI gross | 6,7% | 10% |

| ROI net | 4,6% | 5,7% |

| Comparison ROI net | +24% | |

| Pros |

Provided that the payment method is 1 cheque, you get the rent earlier. No need for furnishing the property. |

Much more flexibility when it comes to viewings. Easier to sell. No risk of payment defaults. No problems with eviction. Option for self use. |

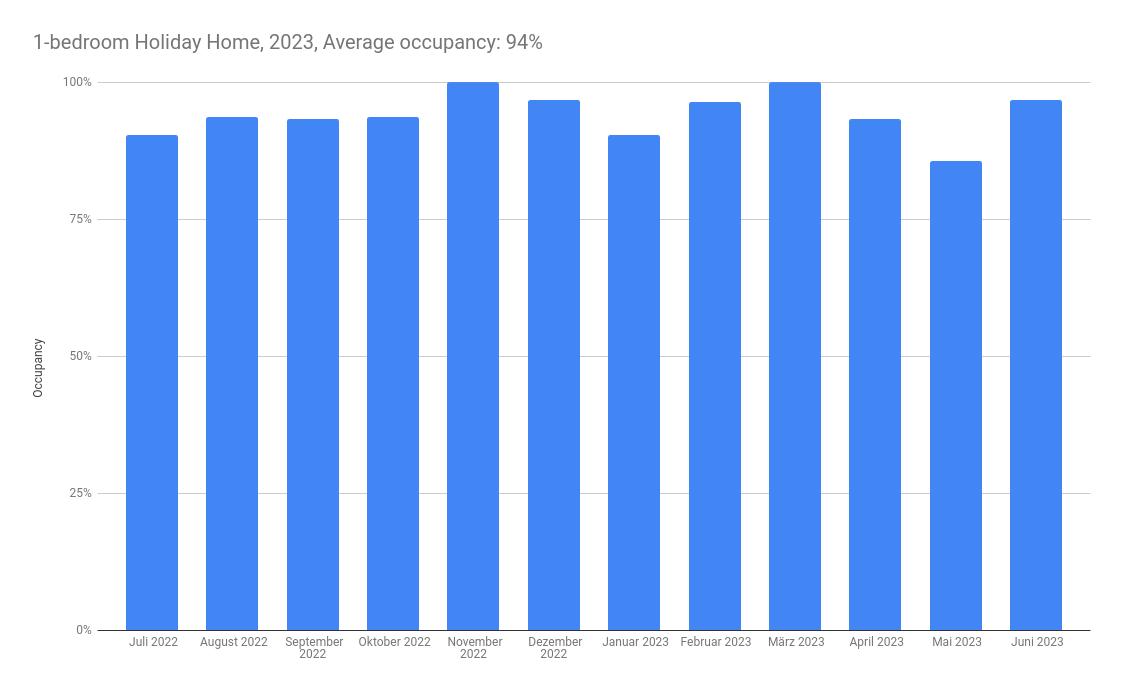

Conclusion: If you're not in urgent need of cash flow, short term is the better option. It will earn you 20% to 30% more on your investment.

We are happy to answer your questions about using your unit as a holiday home (AirBnB) in Downtown, Jumeirah 1, 2, 3, Mina Rashid, Marina, JBR and on the Palm.